November 4, 2020

Managing risk has never been more imperative as aviation businesses are charting their paths toward recovery—and the eventual resumption of growth—while eyeing emergent investment opportunities amid the Covid19-strained global operating environment. Zeevo Group (“Zeevo”) discusses the resources, processes, and commitments required to successfully manage enterprise risk during the M&A integration process.

This article appeared in the November 2020 annual issue of Airfinance Journal. Published with permission from the publication.

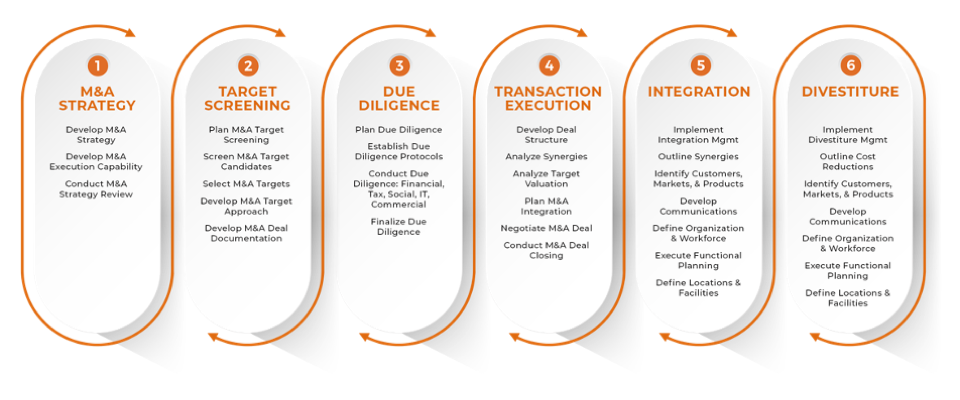

With a constantly shifting business landscape compounded by the effects of the pandemic and the uncertainty surrounding the industry’s nascent recovery, mergers and acquisitions (“M&A”) can be a crucial tool for the long-term strategic growth of businesses, particularly in the case of aircraft leasing platforms that are poised to enter new markets or augment their fleet portfolios.

Zeevo Group Chief Executive Officer Joey Johnsen stresses, “the success of the integration process lies in the business’ ability to extract maximum value from an M&A transaction.”

Transactions in the leasing space require long-term planning and strategic integration to optimize returns. M&A transactions alter the risk profile of the combined organization as existing risks evolve and new risks emerge during the integration process.

“In fact, the ability to effectively manage operational and internal control risks can be a deciding factor for the combined company’s survival,” asserts Johnsen. “It is imperative to identify and mitigate risks related to people, processes, and systems as a key component of the integration process.”

While the immediate focus during an integration of two companies is on external customers, vendors, and employees, the post-implementation challenge requires building an efficient infrastructure to capture synergies, particularly in finance, accounting, governance, and compliance.

“The complexities of the integration process often result in companies’ being overwhelmed by the process, focusing solely on the technical aspects of the integration, while assuming the control environment will be properly addressed,” warns Johnsen.

While lessors may be well-prepared with effective risk management and internal control structures, supported by Strategic Planning & Analysis and Trading teams, these structures are likely not designed to meet the needs of the combined organization.

Johnsen explains that “the lack of focus on integrating and right-sizing the control environment is among the most common reasons why lessors fail to achieve synergy goals during the integration and post M&A implementation phase.”

Balancing Compliance with Process Improvements and Risk Assessments

Solid PMO/IMO

Embedding a controls team within the overall project team and developing an integration strategy for risk and internal control transformation will ensure the combined organization successfully captures synergies and builds for the future.

“The integration planning must run in parallel with deal negotiations,” stresses Johnsen. Pointing to the need for leadership to ensure functional representatives from finance are at the table from the get-go.

“Establishing a dedicated finance arm of the project/program management office (“PMO”) or integration management office (“IMO”) to track milestones and identify and address identified integration issues is key to a successful integration.”

Internal Controls Work Stream

The internal controls work stream should include key risk and internal control professionals, with each focused on specific business process and technical work streams. The risk and internal controls strategy must be anchored in proactively addressing critical areas during the integration process by considering its impacts on people, systems, and processes.

“An effective risk and internal controls strategy will provide a guideline to govern decision-making related to risk and controls for the combined organization, making it less likely for leadership to overlook critical areas and for decisions to be ad hoc,” elaborates Johnsen.

Risk and Internal Controls Strategy Informing Decisions at All Stages of Integration Process

People

The effectiveness of the resulting business process can be significantly affected by culture. The internal controls team must take into account the combined entity’s different cultures, risk tolerances, and working styles in considering the adoption of new processes and controls to effectively adapt to the new risk profile.

Johnsen emphasizes that analyzing these differences and clearly defining risk and control objectives will result in an approach that the internal control team can adopt to “eliminate the common cultural obstacles and define the necessary changes in the combined organization” that will bring cultures together, drive better control execution, and ensure the effectiveness of the resulting processes.

Systems

Designing and implementing interim and bridge controls while addressing the to-be processes are the requisite steps to effectively leverage system functionality during the integration process.

“Understanding technology risks and ways to mitigate and control IT system development projects and applications, data quality, and integrity are key to an effective final system integration,” declares Johnsen.

By granting the right access to systems while restricting it where necessary, the internal control team will eliminate conflicting duties during the integration process. The team must also be tasked with the design and development of user monitoring processes to address the risk of uncontrolled access and resolve existing issues as part of implementing the new process and system design.

“Key stakeholders from across the business, who understand the data and its importance to the user community, must be involved from the get-go in the design of the to-be environment,” stresses Zeevo Group Chief Technology Officer John McCartney.

These stakeholders’ understanding of differences affecting data integrity, as exemplified by work orders, a key input to the asset unitization process where data elements are usually different among the entities, will help arm the combined organization with appropriate controls for data cleansing, conversion, and validation processes, ensuring there are no issues with asset unitization in the to-be data model down the line.

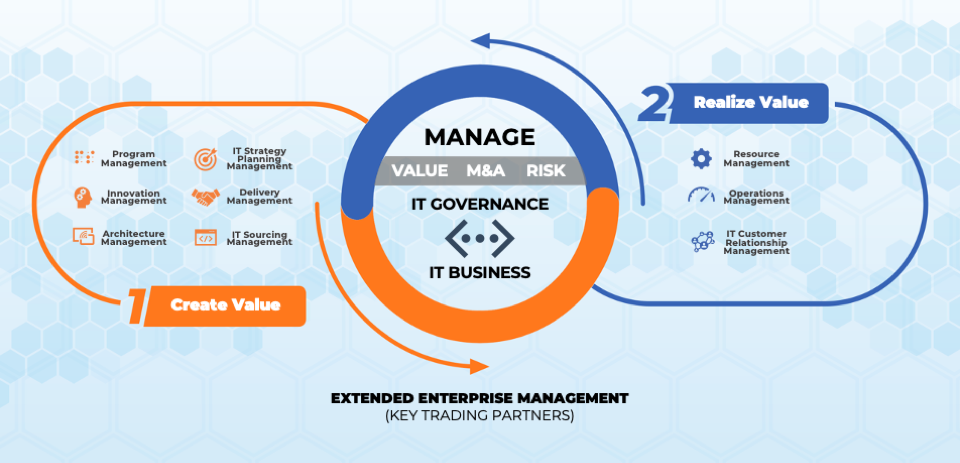

IT Management Framework Delineates the Roles and Capabilities of the Information Technology Organization in Terms of Processes, Tools, and Performance Measures

Processes

The differences in various business processes, including external and management reporting, will affect the end-state operations of the combined organization. The internal control team must evaluate these differences and determine the desired process and procedure for each relevant business process.

The internal controls team should collaborate with the finance organization to develop an accounting policy playbook that evaluates differences and their impact on data conversion, transaction recording, and operational and financial reporting.

Some key questions the internal controls team should ask during design to understand these differences include:

- How are items classified when they are initially recorded; are they considered inventory, or are they capitalized on the balance sheet as financial assets?

- How are purchase requisitions (“PRs”) and orders (“POs”) maintained in each companies’ respective system(s)?

- What PRs and POs need to be transferred to the combined company’s system of record (e.g., open PRs and POs only, how much historical data will be brought across)?

- What does the new signing authority/delegation/grant of authority matrix look like, and at what level of detail must supporting documentation have to make purchasing decisions, investment decisions, etc.?

The internal control team should clearly understand the differences between each entity and assist in the creation of routines that bridge these differences. In addition, the internal control team assists in enabling the development of to-be processes based on the combined entity’s policies, procedures, and external/internal reporting requirements.

Clearly understanding and documenting the process differences and affirmatively making a decision about the end-state processes and procedures provides the foundation to achieve completeness and accuracy of information and reporting.

Finance, Treasury & Tax Are Central to Merger’s Success

The Chief Financial Officer’s (“CFO”) organization, along with its finance, treasury, and tax teams, are central to a merger’s success and face numerous challenges during the integration process.

“While assisting the finance transformation efforts for a range of publicly listed, global organizations across industries, the first priority I always communicate to client teams is to determine the priority plan for things needing to change by arraying the integration responsibilities across the dimensions of size, risk, and effort needed,” reflects Johnsen.

Typically, the highest value, lowest risk, and the easiest to analyze responsibilities should be addressed first. Then, successive waves of responsibility should include those that are of lower value and need more time to analyze and implement to minimize risk.

However, the entire process can be altered depending upon the type of entities merging and their individual sizes.

Governance, Risk, and Compliance

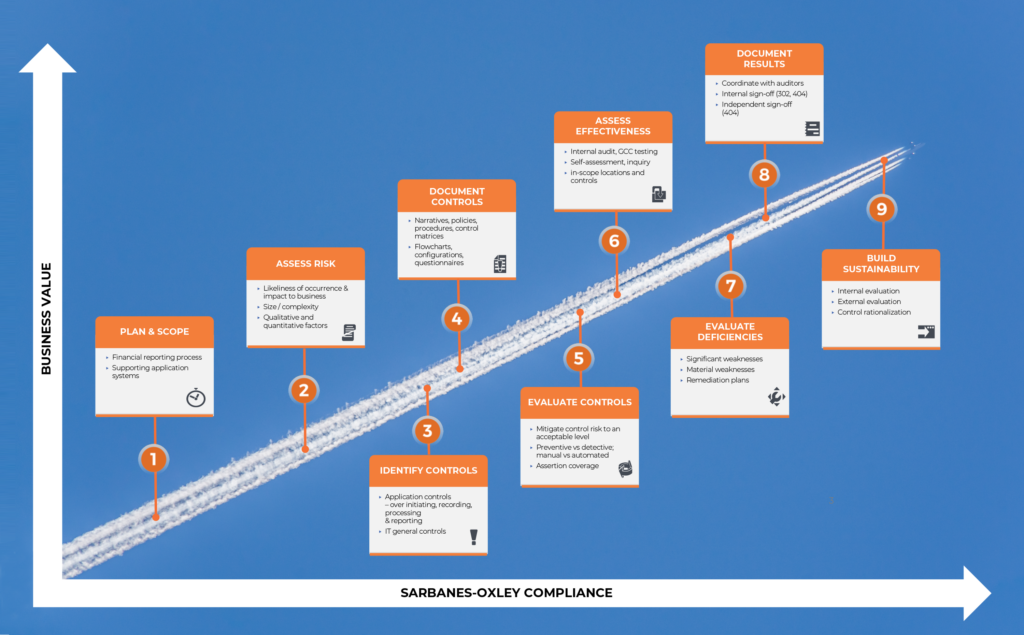

An effective, internal control environment provides confidence to leaders that their organizations can meet the demands of changing environments. Lessors must comply with regulations, respond to events of noncompliance, and improve processes around information systems that support Governance, Risk, and Compliance.

“An ounce of prevention is worth a pound of cure,” explains Debbie Anderson, Zeevo Group Chief Accounting Officer and internal controls expert. “Sound governance, internal controls, and compliance practices demonstrate credibility to regulators, investors, and analysts.”

Moreover, sweeping regulatory mandates, such as Sarbanes-Oxley, complicate the integration process by adding to the complexity already created by industry-specific and country-specific regulations.

Contract Compliance

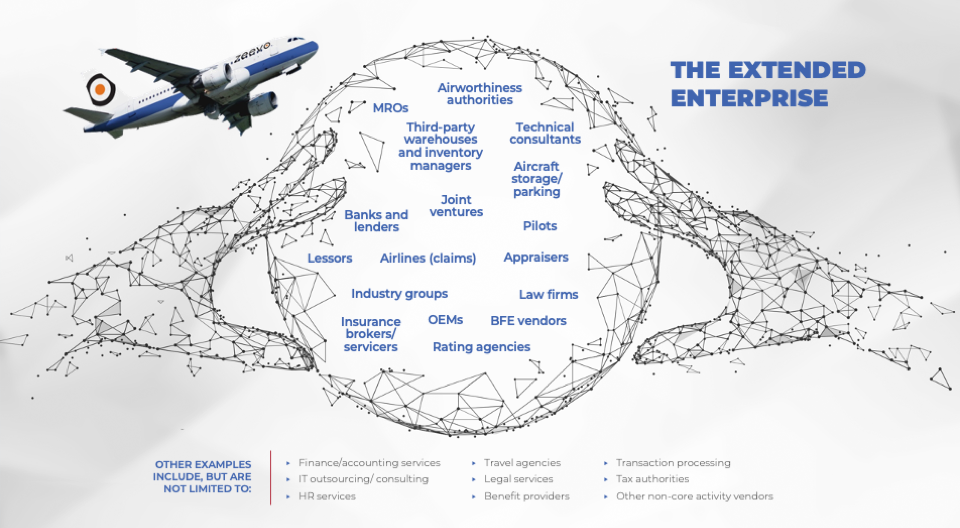

Strategic alliances are increasingly important in today’s business environment. Extended business relationships, formed through partnerships, vendor relationships, and outsourcing arrangements, are pervasive and have replaced the traditional closed-end business structure of yesteryear. This collection of relationships is often referred to as the “extended enterprise.”

Aircraft lessors increasingly:

- Rely upon original equipment manufacturers (“OEMs”) to manufacture and source aircraft and engines;

- Depend on advisors to market, sell, and deliver on promises to lessees and prospective lessees; and

- Use vendors to provide support services.

The Extended Enterprise

“Organizations must understand the complexities and nuances of a range of business contracts, processes, and procedures while maintaining and improving relationships with clients and business partners throughout the integration and transition into the combined entity,” stresses Anderson.

Accounting Policies

Companies often underestimate the time and expertise required to standardize accounting policies for the merged organization during the integration process.

A vital step in an integration of two companies is to reconcile accounting policy differences and identify short- and long-term plans to address any underlying issues.

Bringing in accounting policy experts to consult with the new entity’s leadership usually helps to put in place a solid plan and timeline for the unification of the differing policies and processes.

- Develop a new Securities and Exchange Commission (“SEC”) and regulatory reporting calendar for the combined organization;

- Recognize data strategy issues and accounting policy differences early to fix any underlying issues.

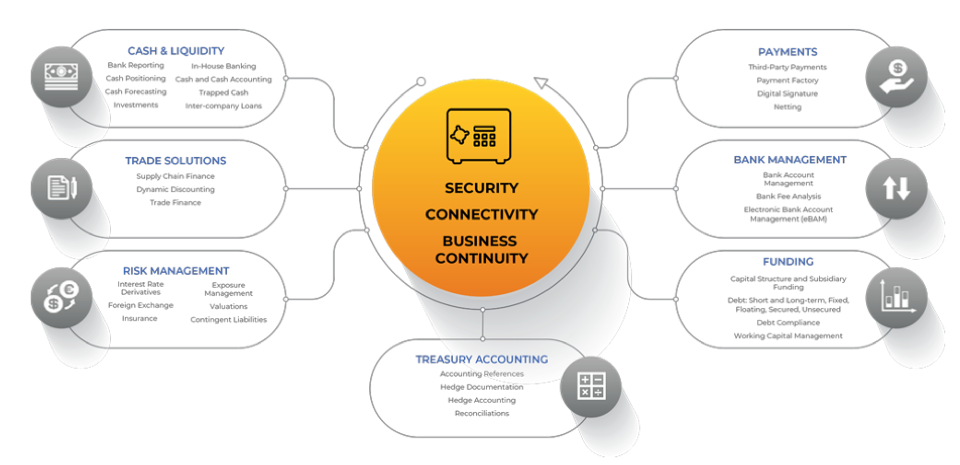

Cash Management

During the integration process, the lack of controls around cash management oftentimes will lead to fraudulent activities, missed filing deadlines, and improperly accounting for transfer pricing transactions.

Treasury is primarily about liquidity and ensuring your company has enough cash to survive – CASH IS KING – it is the life / heart of any organization, and Treasury keeps the heart pumping.

It is critical to reconcile cash and bank account balances on Day One while implementing proper cash management controls. Companies also need to integrate hedging and foreign exchange (“FX”) cash management strategies while addressing the cashflow needs of the newly combined business.

- Determine who has cash management authority and reconcile cash and bank accounts on Day One;

- Integrate hedging and FX cash strategies and develop transfer pricing accounting procedures.

Paul McDowell, Zeevo Senior Advisor, singles out contingent liabilities as an “all-too-often overlooked aspect of cash management.”

McDowell explains that there are usually several contingent liabilities that might be unnoticed. “Even with smaller deals, you will find contingent liabilities with credit card programs, certain contract obligations, and operating leases. Since these liabilities are not recorded on the balance sheet, they get overlooked and are sometimes unaccounted for during due diligence.”

In addition, during the integration process, integration teams must account for bank accounts, bank relationships, potential rating agencies, venture capitalists, investors (debt and equity), ongoing transaction execution – all within a well-controlled environment.

Controls Around Treasury, Accounting, and Cash Management

Reporting

It’s critical for leadership to understand the limits of and adjust their expectations for reporting post-acquisition, while carefully planning for data migration and storage of historical financial information to allow for comparative and performance analyses.

- Understand limits for reporting post-acquisition and plan for the first combined set of reports;

- Communicate the expected synergy capture to the finance functions during budgeting and planning activities.

“Leadership must take early action to develop a regulatory reporting calendar and an interim approach to data strategy, bridging differences, and planning for a longer-term fix,” adds Anderson.

Synergy Analysis Identifying the Incremental Flows that Impact the Valuation of the Target Company

Accounts Receivable

Improperly monitoring accounts receivable (“AR”) during the integration process will result in increased enterprise risk and negatively impact the new combined entity’s cashflows.

“Organizations must ensure a clean cut-off of lockbox and remittance guidelines to limit post-Day One AR reconciliations,” stresses Anderson.

Companies can successfully manage enterprise-wide risk with Day One credit and receivables reporting until one customer, order management, and AR data warehouse exists for all customers.

- Manage enterprise-wide risk with Day One credit and receivable reporting;

- Ensure a clean cutoff of lockbox / remittance guidelines to limit post-Day One accounts receivable reconciliations.

Cost Synergies

One of the key benefits of merging two companies into one entity is cost synergies. However, integration teams often fail to recognize the importance of unifying internal procurement policies and expense approval processes immediately post the merger. In turn, expenses and capital expenditures can run afoul and the combined leadership’s ability to negotiate competitive contracts with vendors can be hampered.

The standardization of purchase order, invoice, and employee expense approval limits and processes for all levels across the new organization should be top of mind for integration teams.

In addition, it is critical to develop consistent capital expenditure approval process and reporting for the merged organization, and review vendor contracts to reflect the new merged legal entity.

- Take advantage of the merger to renegotiate vendor discounts with terms which will improve cashflow;

- Standardize purchase order, invoice, and employee expense approval limits and processes for all levels.

Zeevo’s Comprehensive Approach to Integration Execution

Zeevo can assist

An effective, internal control environment provides confidence to leaders that their organizations can meet the demands of their changing environments.

With extensive backgrounds in finance, technology, operations, risks, as well as all aspects of aircraft leasing and M&A transactions, our team of industry experienced professionals are well versed in assisting CFOs and executives across their enterprises in strengthening their internal control environments and risk-related decision-making processes.

Zeevo’s multi-disciplinary M&A service offerings can help unlock the value of an investment by touching all dimensions of shareholder value through our road-tested approach to executing the integration process.

We have assisted companies across industries in achieving success by ensuring the integration process is executed as needed against the different M&A strategies.

About Zeevo Group LLC:

Zeevo Group LLC (“Zeevo”) provides business, finance and information technology consulting services and products to a broad range of clients representing such key industries as aircraft leasing, technology and consumer products. zeevogroup.com

Media Contact:

Direct: +1 760 933 8607

contactus@zeevogroup.com